If LinkedIn had a resume, its experience in China would certainly be a noteworthy one.

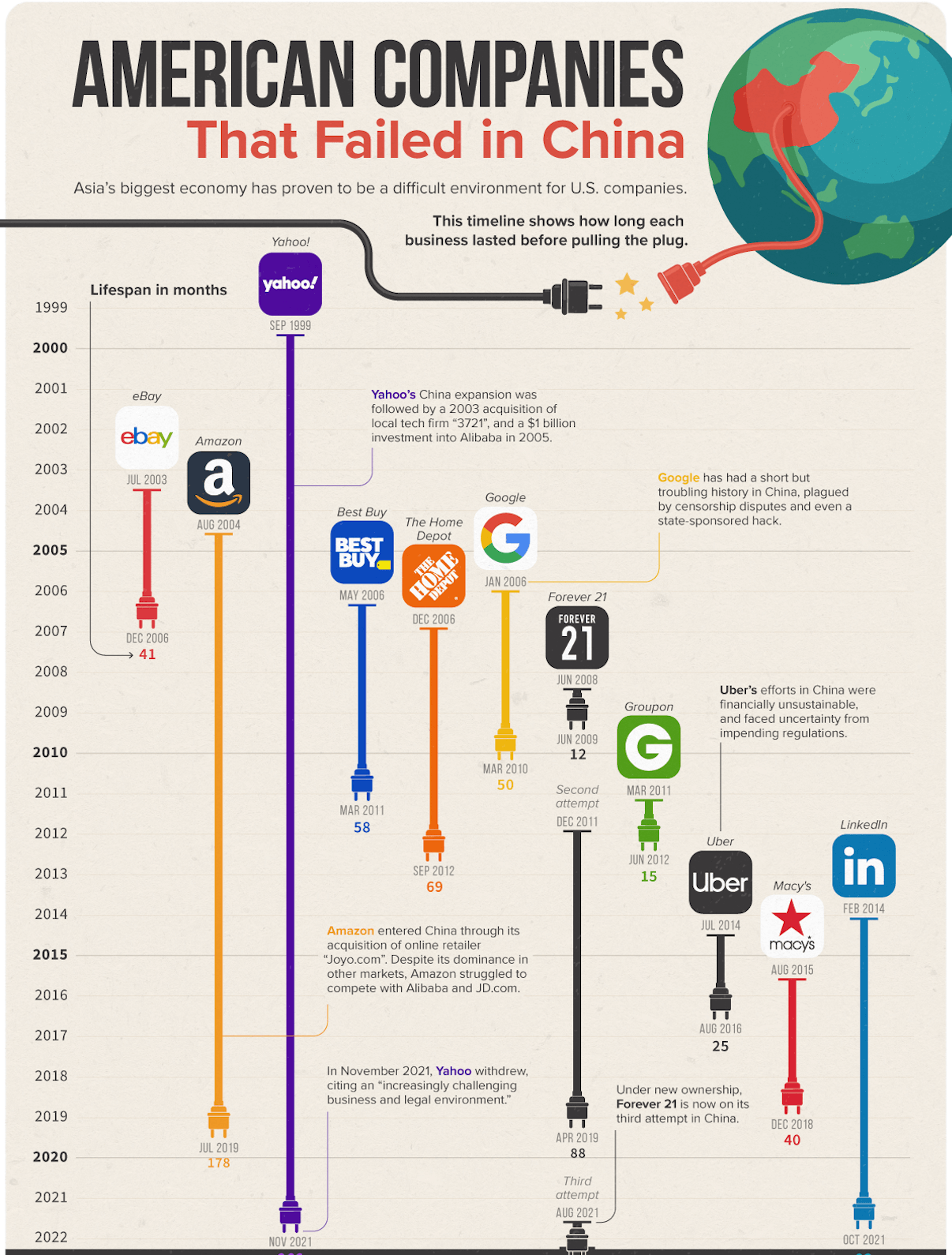

In 2014, LinkedIn launched in China. It aimed to become China's ultimate professional networking site. In 2021, LinkedIn ceased its core service. For eight years, LinkedIn in China had never reached the same success it had in U.S.

It had the ingredients to win.

✅ It was led by a Chinese tech entrepreneur with ties to both China and U.S.

✅ It received full autonomy from the U.S. headquarter.

✅ It blended into China's internet ecosystem and secured partnerships with WeChat and Alipay.

✅ It complied with the Chinese government's regulation.

It checked all the boxes. How did it go wrong?

Misunderstood Chinese Professional Networking

While LinkedIn did manage to sign up many Chinese users with overseas experience, it did not provide too much value for China's vast majority.

Unlike American counterparts who keep life and work separate, majority of Chinese professionals manage both social and professional contacts in one app, WeChat. An exchange of WeChat contact info is like an exchange of business cards. As long as two people are connected on WeChat, they are all set. To them, there is no difference between social networking and professional networking.

Also, connecting online via weak ties may be a common practice in U.S., but it is not how professional connections work in China. Chinese professionals tend to build connections offline first upon a mutual friend's introduction.

Given the existing norms in China, a widespread adoption of LinkedIn was difficult to achieve in the first place.

Operation Constraints

Although office granted the China team total autonomy, LinkedIn China still faced constraints that prevented it from operating like a 100% Chinese company.

LinkedIn China lacked many localized features in its early days. For example, phone-registration and local payment integration were not available and remained long-standing issues. Adding those changes would often involve the global team based in U.S. and take an extremely long time to build. The loss of agility thwarted LinkedIn China’s progress.

Another factor limited growth was budget. Chinese internet companies tended to spend a lot money on marketing and offline promotion events to acquire users. The home office, on the other hand, believed good products should sell themselves and saw little ROI from campaigns previously ran by the China team. The home office’s bias about not paying for growth and the local team’s failure to build a convincing case led to a deadlock.

Misguided Pivot

In 2015, the China team proposed to build a new product.

The team reasoned that LinkedIn was born during the PC era. It needed to build a mobile-first product tailored to the China's vast majority, not just people with overseas experience.

In addition, the local team believed that the new venture would allow them to operate like a startup and exercise complete autonomy.

Under the new proposal, the new app and LinkedIn would remain separate, serving two user segments.

The home office agreed. After just 3 months, a brand new app - Chitu - was born.

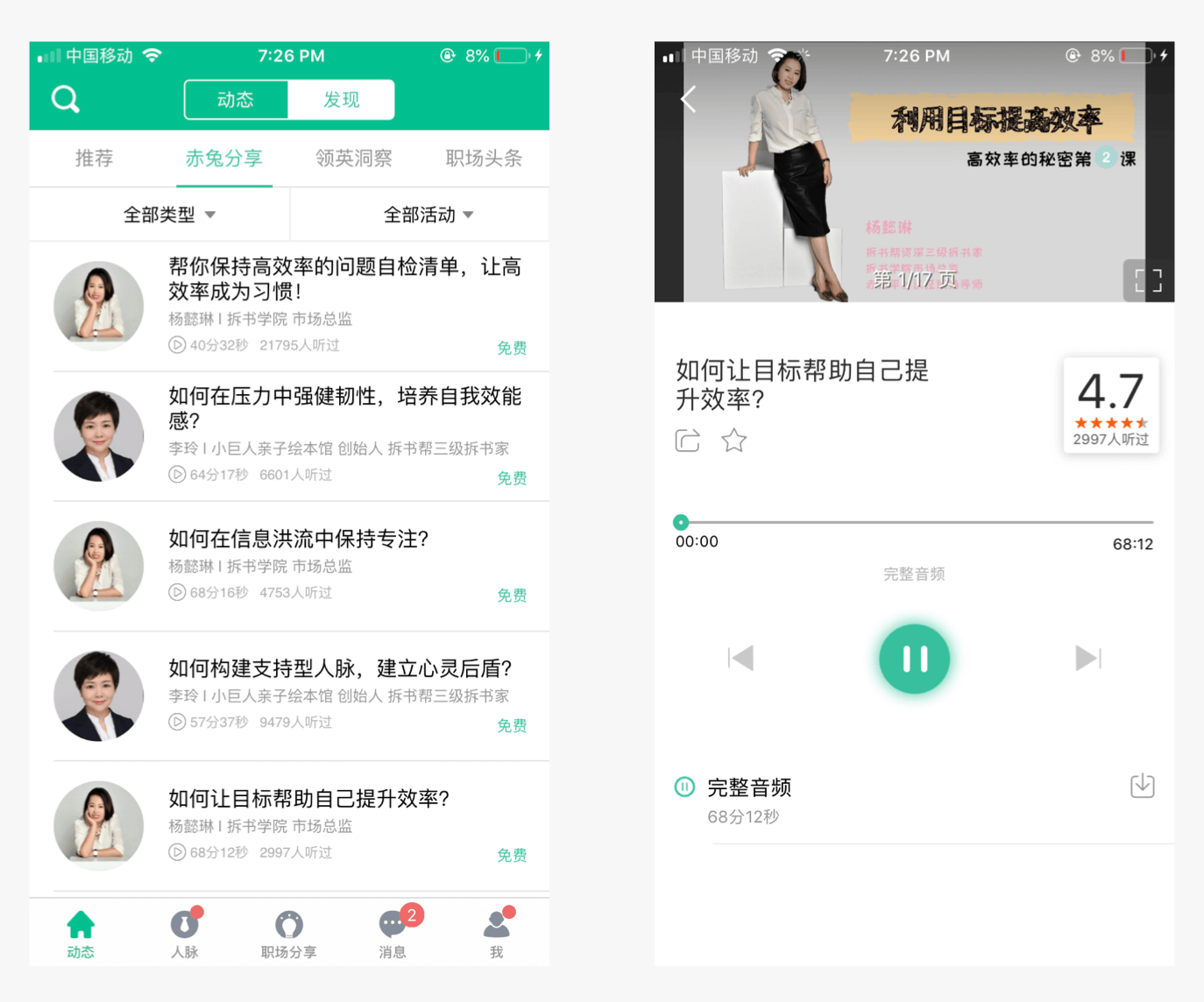

Chitu inherited many LinkedIn's features and added new ones, such as offline networking events and knowledge broadcasting.

However, Chitu did not live up to its promise.

As a standalone product, Chitu found itself stranded in a race with local competitors. What had set LinkedIn apart from those competitors was its global network. But, positioned as a separate product, Chitu could not leverage LinkedIn’s core advantage. Competing services like Maimai, an anonymous professional network site, outperformed Chitu.

To make things worse, the new venture diverted attention and investment away from LinkedIn. Without continued investment, LinkedIn gradually lost its traction and remained underperformed. Noticing the performance drop, the home office shut down Chitu during its second year and redirected focus back on LinkedIn.

Since Chitu’s failure, LinkedIn has been less progressive in China. In Oct 2021, the company shut down LinkedIn’s networking feature in China, because of a “significantly more challenging operating environment and greater compliance requirements in China”.

Its current version has minimal features. Instead of connecting professionals, the downsized product will now focus on connecting individuals with professional opportunities.

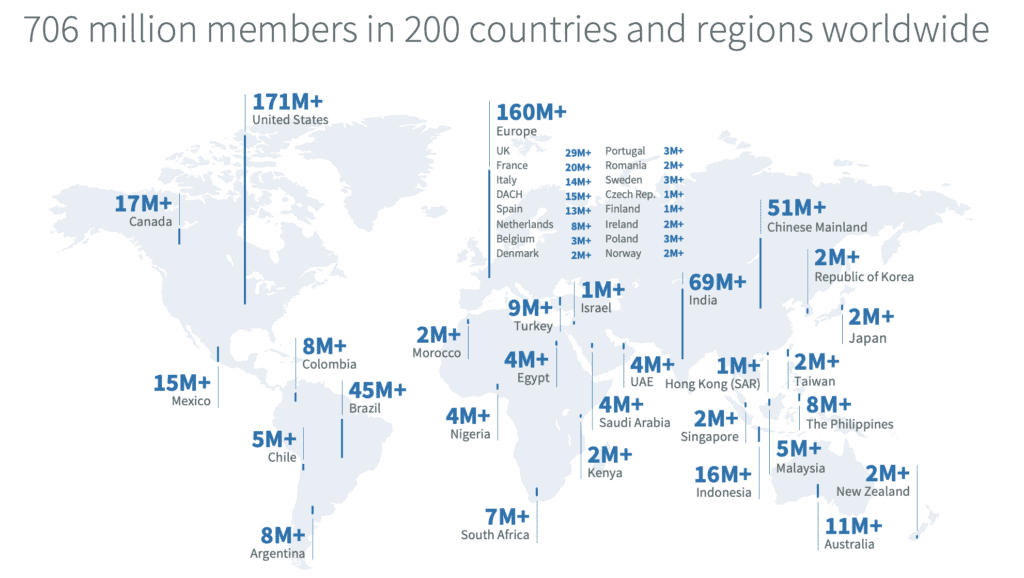

With 51 million users in China, LinkedIn still remains relevant in the arena.

How well will it play the new strategy? It is worth finding out.